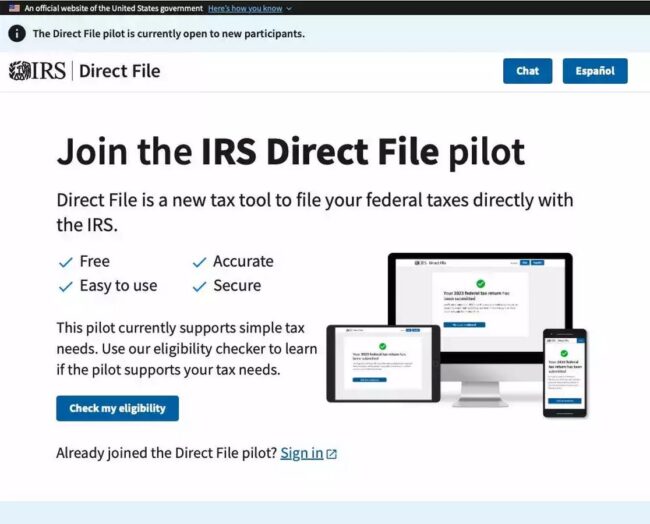

Free IRS Direct File Service Available in 12 States

A new option has emerged for US taxpayers to file their taxes directly with the Internal Revenue Service (IRS), offering a free and convenient method that mirrors practices common in many other countries.

Introduction of IRS Direct File Software

The IRS has launched its Direct File software in a pilot phase, allowing taxpayers to file their annual taxes online directly with the federal government. This software, named Direct File, has opened for a pilot phase as of Wednesday, with plans for a broader public release in mid-March.

Eligibility and Limitations

While the service is free to use, there are specific eligibility criteria and limitations. Taxpayers must have been residents of one of the 12 designated states for the entirety of 2023 and should not have earned income from any other state. The list of currently eligible states includes Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Service Features and Restrictions

Direct File is currently tailored for “simple” tax returns, accommodating individuals with W-2 wages and basic tax credits and deductions. However, taxpayers with health insurance purchased through platforms like HealthCare.gov or funds from Health Savings Accounts are ineligible to use the service. Similarly, individuals with other types of income, such as gig workers or independent contractors, and those with more complex deductions or credits, cannot utilize the service at present.

Additional Eligibility Considerations

The service is also subject to income limitations, with households earning over $125,000 and married couples with combined incomes exceeding $250,000 ineligible to use Direct File. Despite these restrictions, the IRS emphasizes that the software is user-friendly and aims to streamline the filing process. Many early testers completed their taxes in less than 30 minutes.

Availability of Support

To assist taxpayers, the IRS offers live chat support in both English and Spanish, providing guidance on tax-related queries and technical assistance, all at no cost.

As the Direct File software enters its pilot phase, taxpayers in eligible states have access to a convenient and cost-free option for filing their taxes directly with the IRS, marking a significant step forward in online tax services.